salt tax impact new york

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

. Agenda for SALT New York 2022. The demands of the SALT Caucus could impact Bidens 2 trillion infrastructure package. When does this go into effect.

With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair. Residents of New York can take a credit against their personal income tax for any PTE-type tax paid to other states within certain parameters. The Debate Over a Tax Deduction.

The SALT cap limits a. Partner Global Tax Leader Blockchain Digital Assets Deloitte. Agenda for SALT New York 2022.

The Rockefeller Institute of Government and the New York State Division of the Budget have examined the impact of the SALT cap. Readers react to an editorial calling for the elimination of the deduction for state and local taxes and discuss how it affects the middle. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize.

In New York the deduction was. Cuomo called the elimination of the SALT deduction as part of former President Donald Trumps 2017 tax cuts a targeted assault on New York and other states that was. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

The caucus said the cap resulted in higher tax bills in New York California and other. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for. April 7 2021 Louis Vlahos Tax.

The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after. The tax plan signed by President Trump.

This report shows that the cap which is effectively a tax.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

States Help Business Owners Save Big On Federal Taxes With Salt Cap Workarounds Wsj

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Nyc Home Prices Plunge After Salt Deductions Capped

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Supreme Court Rejects Salt Limit Challenge From New York New Jersey

State And Local Tax Salt Deduction Salt Deduction Taxedu

Supreme Court Rejects Salt Limit Challenge From New York New Jersey

House Democrats Push For Salt Relief In Appropriations Bill

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

What Is The Salt Tax Deduction Forbes Advisor

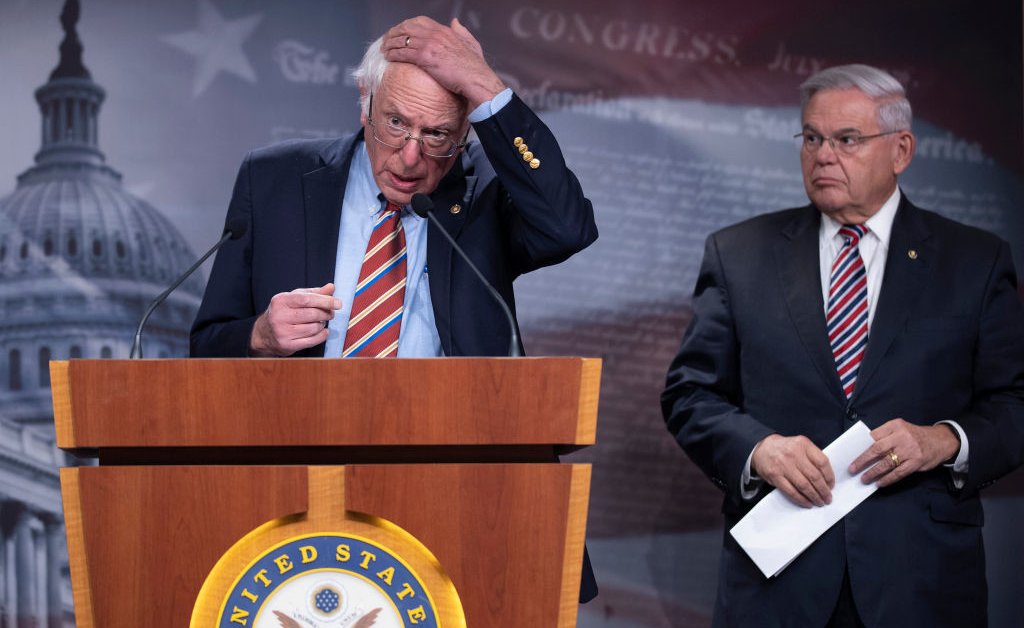

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Why This Tax Provision Puts Democrats In A Tough Place Time

Pin By Laura Batson On Sauces Brown Cups Taste Made Worcestershire Sauce